Maximizing returns for shareholders: a medieval morality play

Over the last couple of years, the mining industry has been through something akin to a religious experience that could well have formed the basis of a medieval European morality play. Who are the players, and what is the plot?

Dramatis personae

- The Evangelists, denouncing sin and pointing to a new way of life.

- The Repentant Sinners, confessing past failings and vowing to lead a reformed life.

- The Hypocritical Backsliders: Repentant Sinners returning to their old lives while outwardly conforming to the new orthodoxy.

- The Voices Crying in the Wilderness, who’ve long been preaching the message but been ignored as crazy zealots.

Synopsis of the plot

The Evangelists are the industry analysts and fund managers decrying the lack of cash returns generated for shareholders of mining companies during the last cycle of high metal prices. At and since the London Mines and Money conference in 2012, they are reported to have challenged the industry to focus on generating returns to shareholders.

The Repentant but Backsliding Sinners are the various company executives who were then reported to have admitted that past strategies had been wrong and that they would henceforth be focussing on generating returns. The focus seemed to swing quickly from maximizing reserves and such to cost cutting. But cost cutting often reduces revenues by more than the cost savings, so the focus changed to productivity, the new orthodoxy. Despite this, underlying strategies have not changed. Anecdotal evidence suggests that longer-term plans are still focussed on “more ounces and lower costs”. Productivity and cost cutting are good if they improve efficiency; bad when they become counter-productive (lost revenue greater than costs reductions); and irrelevant if the plan is going in the wrong direction anyway.

And the Voices Crying in the Wildness? Strategy optimization specialists, for whom it was all predictable (and predicted). Fundamentally, nothing has changed, so we are going to see repeats of poor returns, dissatisfied analysts, fund managers and investors, and beaten-up company executives.

With cash generation now part of the regular discussion, we have an opportunity to change the culture of the industry and the investors who rightly require returns for the risks taken.

Debunking the myths

There is a lot of conventional wisdom in our industry that is demonstrably unwise. In the context of a morality play, we could characterize them as myths. There are a number of these, but there is only space here to deal with one, on which hinge most of the problems described above.

The Myth: There are simple measures that can be calculated regularly to indicate how well a company is delivering long-term value to shareholders

Measuring value?

At the end of the life of a mine, the benefit received was the net cash flow. Value measures must therefore be associated with predicted future cash flows, such as net present value (NPV) and real options value (ROV). There are arguments around which of these is better, but in the context of this discussion, they will both point in the same general direction. NPV is used to indicate the value of predicted cash flows, accounting for both risk and time value of money.

How are value drivers and KPIs related to value ?

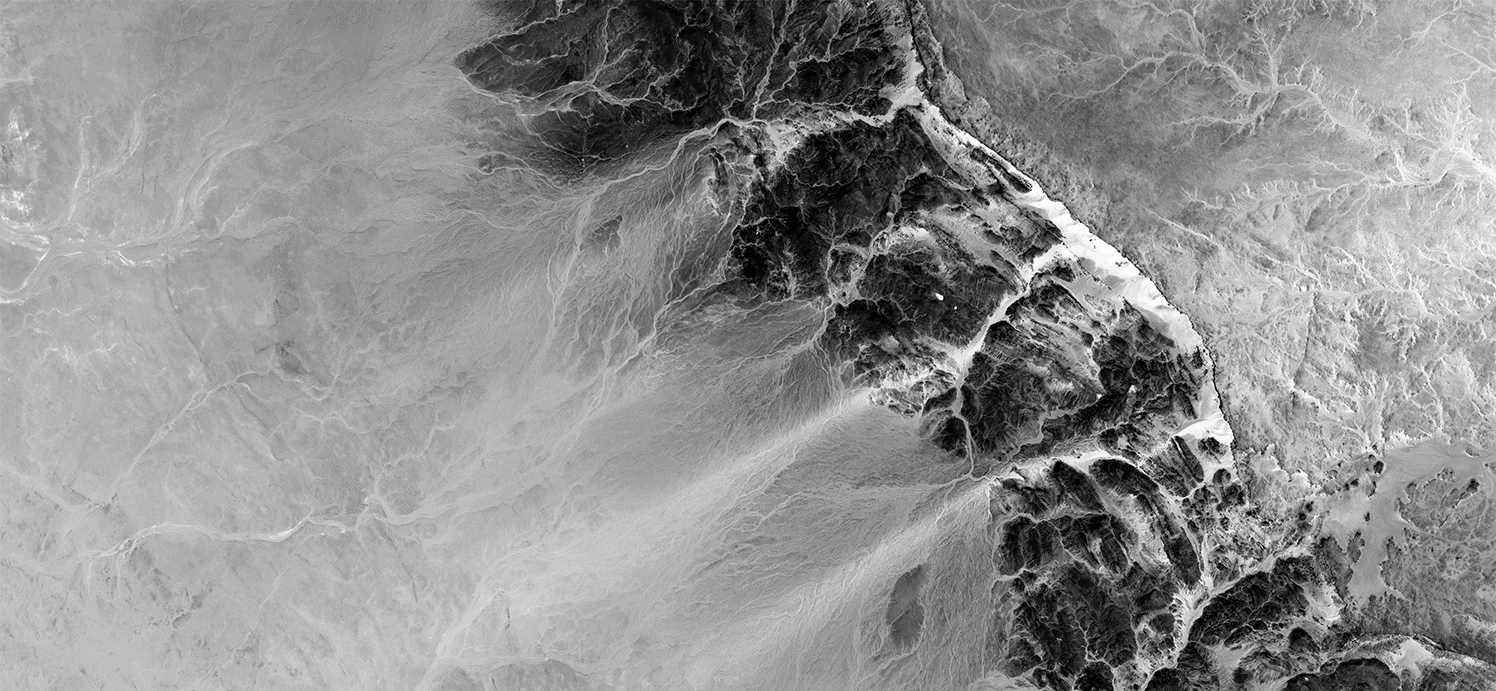

Simplistically, we can plot value as a function of a number of value drivers or key performance indicator (KPI) measures, as shown in the figure below.

The horizontal axis represents driver or KPI values that are improving from left to right, such as:

- Increasing pit size

- Reducing cut-off grades

- Increasing reserves tonnes

- Increasing metal in reserve

- Increasing mine life

- Increasing production rates

- Reducing unit costs

- Reducing total operating costs

- Reducing capital costs

On the face of it, improving each of the listed KPIs should add value, so it seems reasonable to use them as simple surrogate metrics for value. But increasing them will result in the NPV rising and then falling, as shown. In the left half of the figure, improving the metric (from left to right across the plot) is positively correlated with value. But, in the right half of the figure, improving the metric is negatively correlated with value!

So value is not maximized by simply maximizing the value of any one of the KPIs listed. Reducing the cut-off or increasing the pit size for a given resource brings in unprofitable material. Increasing the production rate and hence capital investment reaches a point where the accelerated receipt of revenue does not pay for the cost of the additional capacity. Also, the high production rate may increase dilution and drive down the head grade. Reducing costs is good while improving efficiency and reducing waste, but bad when it leads to reduced productive capacity and reduced revenue.

Using simple KPIs as surrogates for value

Despite their shortcomings, these KPIs are still used as surrogates for value creation and control by mine managers and market analysts. Unfortunately the experience of strategy optimization practitioners is that almost all mines are operating in the right half of the figure, where improving the values of the surrogate measures of value leads to reduced value for shareholders. So managers and analysts are (still) focussing on metrics that are negatively correlated with value creation.

What other “simple” KPIs are correlated with NPV or similar measures of value creation, so that managers and analysts can track how well a company is heading towards its long-term goal of value maximization in the short term? As far as I can see: None! I’m happy to be corrected! So, to summarise:

There are currently no simple measures from an operation that are correlated with value creation.

The simple metrics generally used are almost universally negatively correlated with value: improving the surrogate value measures results in reduced cash generation for shareholders, and vice versa

In principle, then, it would seem that the solution is to:

- Identify the optimal long-term plan that delivers maximum value for investors.

- Generate detailed short-term plans focussed on delivering the long-term plan, not on metrics negatively correlated with value creation.

- Develop reporting and control measures that deal with plan compliance and, perhaps more importantly, returning to the long-term plan when the inevitable short-term disturbances deflect the operation from it.

- Communicate the value-maximizing plan and the measures to be used to control its implementation to operators, managers, and market analysts, so that everybody is focussing on measures that are truly correlated with value generation.

At AMC, we have the technical and analytical skills to do items 1 to 3 for our clients. Items 1 and 2 are discussed in Cut-off grades and optimising the strategic mine plan (available from The AusIMM online shop). Item 4 is the tricky one, and involves technical experts, company managerial and executive staff, and analysts and fund managers coming together to work out how to make it work.

Albert Einstein is reputed to have said that: “Insanity is doing the same thing over and over again and expecting different results”. If we don’t all change the way we do things, we’ll just keep going round in circles.

Brian Hall

Principal Mining Engineer

Subscribe for the latest news & events

Contact Details

Useful Links

News & Insights